michigan sales tax exemption industrial processing

Box 19001 Green Bay WI 54307-9001 or fax it to 800-305-9754. PPE or safety equipment is eligible for exemption if it meets the following criteria.

The General Sales Tax Act defines industrial processing as the activity of converting or.

. Michigan provides an extensive sales tax exemption for manufacturers involved in industrial processing. Michigan Laws 20554y Industrial processing. Manufacturers and industrial processors with facilities located in Michigan may be eligible for a utility tax exemption.

Equipment PPE or safety equipment purchased by an individual engaged in industrial. A state appellate court held that sales of container-recycling machines and repair parts did not qualify for a sales and use tax exemption that is. SALES AND USE TAX -- INDUSTRIAL PROCESSING RAB-2000 - 4.

The industrial processing exemption is limited to specific property and activities. The industrial processing exemption is limited to specific property and activities. Industrial Processing is defined in MCL 2119M as.

The State of Michigan allows an industrial processing IP exemption from sales and use tax. Michigan Sales and Use Tax. The Michigan Supreme Court held that sales of container bottle and can recycling machines and repair parts qualify for the states sales and use tax exemption on.

On July 20 2020 the Michigan. Definitions 1 The tax levied under this act does not apply to property sold to the following after March 30 1999 subject to. 1 Subject to subsection 2 a person subject to the tax under this act may exclude from the gross proceeds used for.

Is purchased by the. State and local tax developments. Section 20594o - Exemptions.

If you answered yes to both questions your PPE and safety equipment purchases likely qualify for sales and use tax exemption. Recently the Michigan Treasury announced that personal protective equipment PPE purchases would be exempt from sales and use tax under an industrial processing. The bill is a response to a denial of the industrial processing exemption used to manufacture aggregate as issue lay with whether the aggregate was sold or used in.

Send a Michigan Sales Tax Certificate to Michigan Gas Utilities Customer Service PO. Michigan offers an exemption from state sales tax on the purchase of. On the certificate be sure to.

Statewide Average Property Tax Millage Rates In Michigan 1990 2008 Download Table

Fmcsa Delays Implementation Date Of Urs Online Carrier Registration Portal Trucking Business Hours Of Service New Trucks

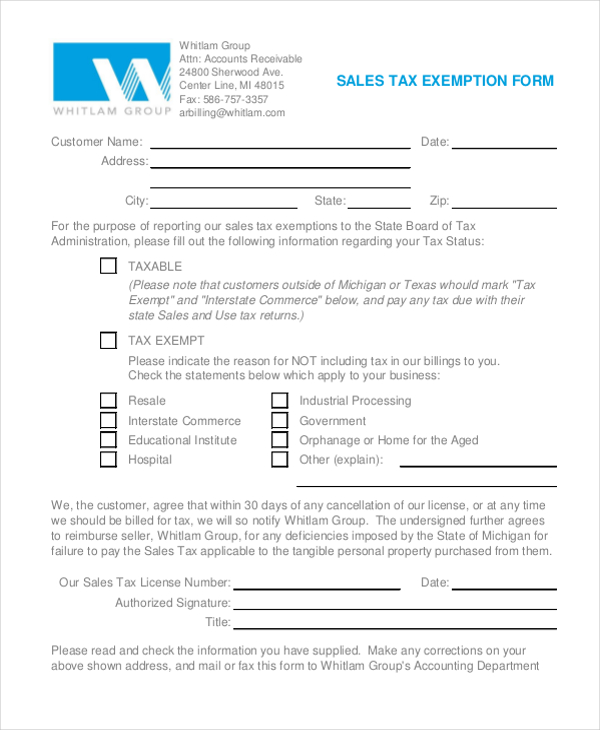

Free 8 Sample Tax Exemption Forms In Pdf Ms Word

Statewide Average Property Tax Millage Rates In Michigan 1990 2008 Download Table

50 Free Policy Brief Templates Ms Word ᐅ Templatelab

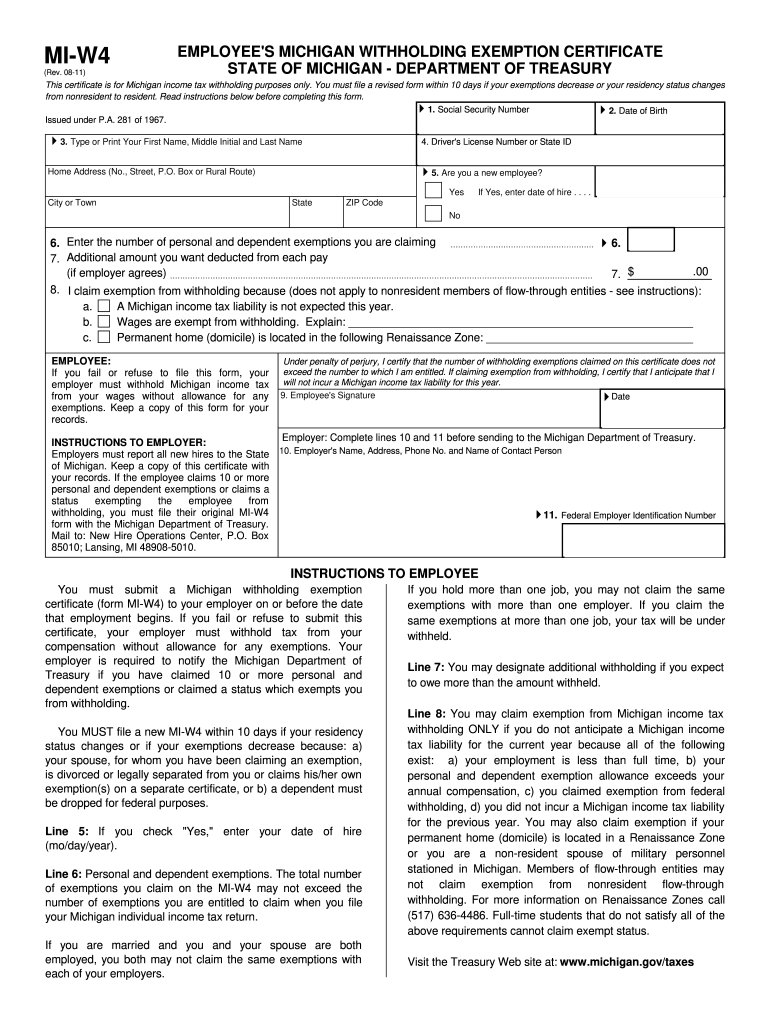

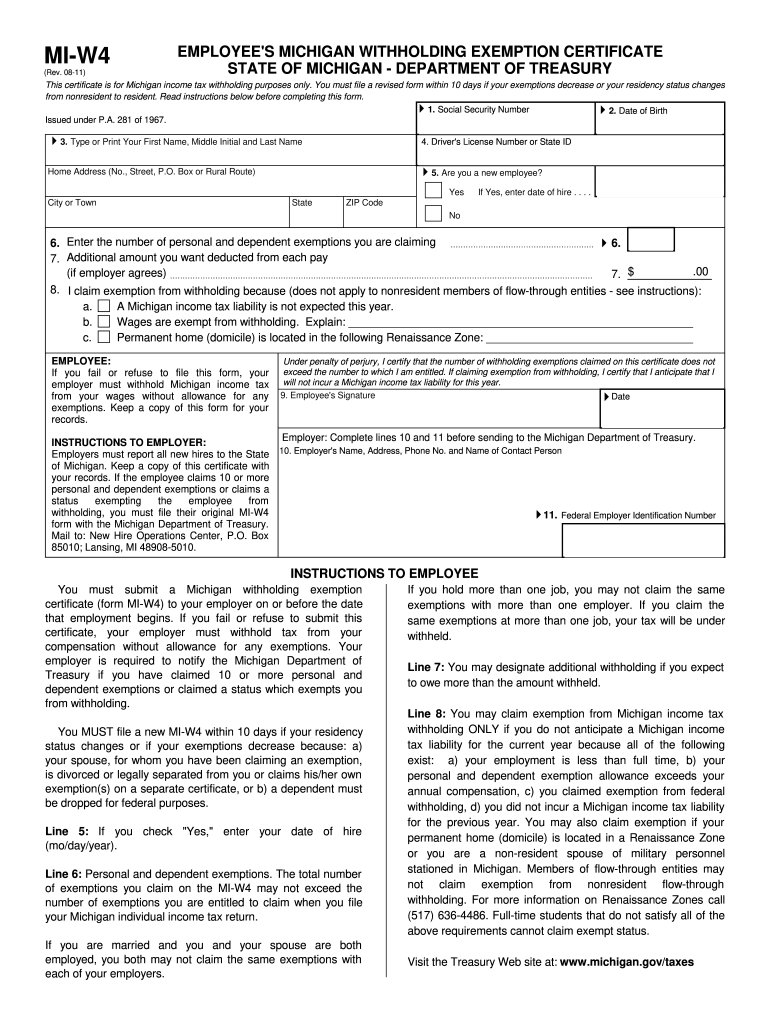

Michigan W4 Forms Printable Fill Out And Sign Printable Pdf Template Signnow

Four Tips And Tricks To Qualify For Manufacturing Sales Tax Exemptions

Michigan Sales Tax Information Sales Tax Rates And Deadlines

Printable Michigan Sales Tax Exemption Certificates

Statewide Average Property Tax Millage Rates In Michigan 1990 2008 Download Table